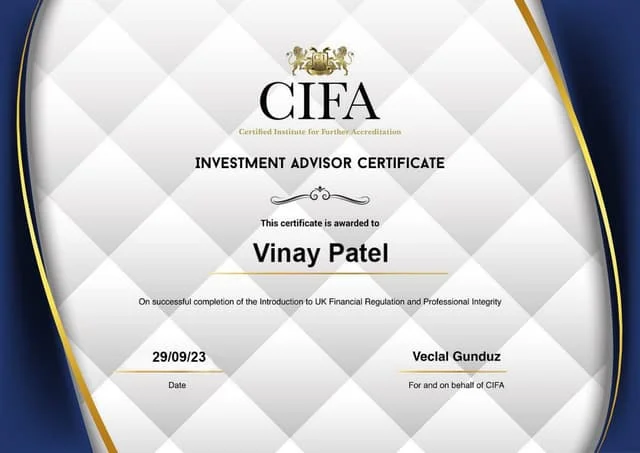

Investment Advisors UK Your Guide to Financial Growth with CIFA

In today’s complex financial landscape, individuals and businesses alike are turning to Investment Advisors UK to help make sound financial decisions. Whether you’re planning for retirement, looking to grow your portfolio, or managing family wealth, having a trusted advisor can make all the difference. At CIFA, we specialize in training the next generation of expert Investment Advisors UK, equipping them with the skills to guide clients through every step of their financial journey.

What Do Investment Advisors UK Do?

Investment Advisors UK are professionals who provide tailored financial advice to individuals, families, and organizations. Their services range from investment planning and asset allocation to tax strategies and retirement planning. In a world of economic uncertainty and ever-changing regulations, these advisors offer clarity and confidence.

At CIFA, we believe that effective financial advice should be personalized, data-driven, and ethical. That’s why our training programs for Investment Advisors UK emphasize client-focused service, regulatory compliance, and long-term strategic thinking.

Why Investment Advisors UK Are in Demand

The demand for qualified Investment Advisors UK is at an all-time high. As financial products become more diverse and people become more interested in long-term wealth planning, the role of a certified investment advisor has never been more crucial.

CIFA recognizes this need and offers a robust training and certification pathway for individuals who want to become leaders in the field. Our alumni are among the most respected Investment Advisors UK, working across banks, asset management firms, and private consultancies.

CIFA: Developing Top Investment Advisors UK

At CIFA, our mission is to develop top-tier Investment Advisors UK who are ready to make an impact. We provide comprehensive certification programs that cover all aspects of investment advisory services.

What makes CIFA different?

Industry-standard certification for Investment Advisors UK

Practical and theoretical training modules

Online, flexible learning environment

Guidance from industry professionals

Career support and placement opportunities

When you train with CIFA, you’re not just learning—you’re preparing to lead.

Core Topics Covered in Our Program

Our certification program for Investment Advisors UK covers a broad range of essential topics, including:

Investment fundamentals

Asset classes and diversification

Portfolio management strategies

Regulatory frameworks and compliance in the UK

Risk analysis and mitigation

Sustainable and ESG investing

Client communication and ethical responsibility

These core topics ensure that CIFA-certified Investment Advisors UK are well-rounded, competent, and client-ready.

Who Should Become an Investment Advisor?

The career of an Investment Advisor is ideal for:

Finance graduates seeking a rewarding path

Professionals in banking or accounting

Entrepreneurs managing personal or client portfolios

Career changers drawn to financial consultancy

Anyone passionate about helping others grow their wealth

At CIFA, we welcome aspiring Investment Advisors UK from all walks of life. Our inclusive programs are designed to support learners at every level.

The Regulatory Landscape for Investment Advisors UK

In the UK, Investment Advisors UK must operate under strict regulatory oversight to ensure ethical conduct and financial transparency. The Financial Conduct Authority (FCA) oversees the industry and requires advisors to hold recognized qualifications.

That’s why a certification from CIFA is so valuable. We ensure our curriculum is aligned with FCA standards, giving our graduates a competitive edge in the field.

Benefits of Becoming a Certified Investment Advisor

There are many benefits to becoming a certified Investment Advisor UK, including:

Enhanced credibility and trust with clients

Access to higher-paying roles in financial firms

Ability to offer a wider range of financial services

Better understanding of tax, estate, and retirement planning

Confidence to manage both personal and client wealth effectively

CIFA is committed to helping our students access these opportunities through world-class training and continuous support.

Investment Advisors UK and ESG Investing

Modern clients care about where their money goes, and Investment Advisors UK need to be well-versed in sustainable investing. CIFA’s program includes comprehensive training on ESG (Environmental, Social, and Governance) investing, ensuring our advisors meet the demands of today’s conscious investors.

By integrating ESG principles, Investment Advisors UK can offer more responsible and future-focused advice to their clients.

How to Get Started with CIFA

If you’re looking to join the ranks of successful Investment Advisors UK, here’s how you can start with CIFA:

Enroll Online – Simple, streamlined registration

Start Learning – Access course materials anytime, anywhere

Pass the Exam – Demonstrate your expertise and commitment

Get Certified – Earn your qualification and begin your career

Our team is always here to guide you, offering mentorship, job placement support, and access to networking events that connect you with top employers in the financial world.

The Future of Investment Advisors UK

As financial markets grow more complex, the need for professional Investment Advisors UK will continue to rise. Technology, sustainability, and global market shifts are changing how people invest—and skilled advisors will be the ones guiding that transformation.

By choosing CIFA, you are investing in a future where your knowledge, credibility, and ethical standards will set you apart. Our graduates don’t just get jobs—they build careers that make a difference.

Final Thoughts

Whether you’re just starting out or looking to level up, Cifa.ac offers everything you need to become one of the leading Investment Advisors UK. With expert training, recognized certification, and ongoing support, we prepare you for a career built on trust, strategy, and long-term success.

Take the first step with CIFA—and become the Investment Advisor the UK needs.